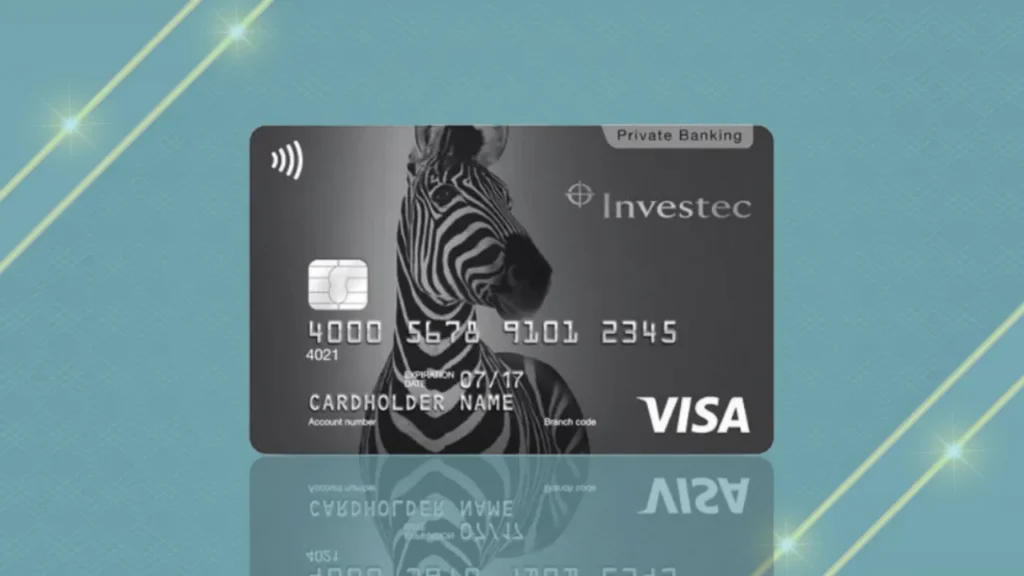

The Investec Credit Card is a Visa Platinum card. It offers benefits like a credit facility priced at prime.

Plus, you get up to 45 days interest-free on all card purchases.

This makes it perfect for managing your finances and saving money.

Check out the exclusive ones for you

Ver todas as ofertasStandard Bank Card

Limit up to 15.400

Free Annual Fee

🎁 5 benefits for you

NatWest Card

Limit up to 5.700

Free Annual Fee

🎁 6 benefits for you

Lloyds Credit Card

Limit up to 4.800

Free Annual Fee

🎁 4 benefits for you

Thinking about the Investec Credit Card? It has many benefits and features.

From interest-free purchases to flexible payment terms, it's designed to meet your financial needs.

In this article, we'll explore its features and benefits to help you decide if it's right for you.

Key Takeaways

- The Investec Credit Card offers up to 45 days interest-free on all card purchases

- The card has a credit facility priced at prime, making it a competitive option

- You can enjoy a range of credit card benefits, including flexible payment terms

- The Investec Credit Card is a Visa Platinum credit card, accepted worldwide

- This card is ideal for individuals who want to manage their finances effectively and take advantage of credit card features

- The Investec Credit Card provides a comprehensive credit card solution with various credit card benefits and features

- You can use the card to make purchases and pay bills, with the option to pay off your balance over time

By clicking the button you will remain on this website.

Understanding the Investec Credit Card Essentials

Understanding the Investec Credit Card is key. It has a credit facility priced at prime, making it affordable. You get up to 45 days without interest on purchases.

The card also offers a budget facility for up to 60 months for big expenses. This helps manage finances better. Plus, it works with digital wallets for easy use.

Knowing the interest rates and fees is important. This knowledge helps you spend wisely and avoid extra costs. The card's rates and terms can save you money.

Here are some key benefits of the Investec Credit Card:

- Up to 45 days interest-free on all card purchases

- Budget facility for up to 60 months for larger expenses

- Competitive credit card interest rates

- Flexible payment terms to help you avoid credit card fees

- Compatibility with various digital wallets for easy account management

By using these features and being aware of costs, you can enjoy your Investec Credit Card. It offers a convenient and cost-effective way to pay.

Financial Benefits and Payment Terms

When looking at credit cards, it's key to check the financial perks and payment terms. The Investec Credit Card has many benefits, like a single monthly fee. This makes payments simple and gets rid of the hassle of many fees. It's great for those who like things easy and straightforward.

The card also offers daily banking ease, letting users handle their accounts and pay bills without trouble. This is a big plus for those who want to manage their money smoothly.

The Investec Credit Card stands out with its budget feature. It lets users pay off big bills over 60 months. This gives more flexibility and makes budgeting easier. When applying for a card, it's important to think about the rewards and the application process. The Investec Card has a simple application and rewards that match your financial aims.

Here are some key benefits of the Investec Credit Card:

- Single monthly fee for simplified payments

- Daily banking convenience for easy account management

- Budget facility for larger expenses, with repayment terms of up to 60 months

- Streamlined credit card application process

- Competitive credit card rewards that align with user financial goals

In summary, the Investec Credit Card offers many financial perks and payment terms. It's a good choice for those looking for a card that's easy to use and offers great rewards. By looking at the rewards and application process, you can decide if this card fits your needs.

Digital Wallet Integration and Technology

The Investec Credit Card works well with digital wallets like Apple Pay and Google Pay. It also supports Samsung Pay, Garmin Pay, and Fitbit Pay. This makes paying easy and convenient, without needing your card.

Using your Investec Credit Card with digital wallets is safe and reliable. It gives you peace of mind when you shop online or in stores. The technology behind it makes payments fast and smooth.

Here are some benefits of using digital wallets with your Investec Credit Card:

- Convenience: Pay easily on the go, without your card.

- Security: Your card info is safer with digital wallets.

- Speed: Payments are quick, perfect for daily buys.

With the latest technology and digital wallets, paying is easier and safer. Whether it's Apple Pay or Google Pay, your Investec Credit Card is ready to go.

By clicking the button you will remain on this website.

Budget Management Features

Managing your finances is key, and credit card budgeting is crucial. The Investec Credit Card has features to help you manage your spending. With family accounts, you can track your family's expenses easily.

The card also offers free travel insurance, giving you peace of mind when you travel. The Investec Credit Card's website and mobile app have tools and resources to help with budgeting. These include:

- Transaction tracking and categorization

- Spending limits and alerts

- Financial management tips and advice

Using these features helps you manage your finances well. The Investec Credit Card is designed to make managing your money easy. It helps you reach your financial goals.

| Feature | Description |

|---|---|

| Family Accounts | Manage your family's expenses and budgets easily |

| Complimentary Travel Insurance | Get peace of mind when traveling with insurance coverage |

| Budgeting Tools | Access valuable tools and resources for credit card budgeting and financial management |

Premium Travel Benefits and Insurance Coverage

As an Investec Credit Card holder, you get special perks for your travels. You'll have dedicated bankers and top-notch travel benefits. These include free travel insurance, which protects you from unexpected trip cancellations and delays.

With the Investec Credit Card, you're covered for any travel surprises. The card's insurance includes:

- Trip cancellation insurance

- Trip delay insurance

- Medical emergency insurance

Also, you'll have access to dedicated bankers. They can help with your travel plans and offer advice. This service ensures your trips are smooth and enjoyable.

The Investec Credit Card is perfect for those who travel often. It offers great travel insurance and personal service. You can travel with confidence, knowing you're well-protected and supported.

Family Account Options and Management

Thinking about the Investec Credit Card for your family's needs? It's great for managing family expenses. With credit card family accounts, you can track spending and budget easily. Plus, a single monthly fee makes payments simple.

The Investec Credit Card offers daily banking ease. This is perfect for families to manage accounts and payments. It helps you keep track of expenses and stay organized.

Some key benefits of the Investec Credit Card's family account options include:

- Easy management of credit card family accounts

- Simplified family budgeting with a single monthly fee

- Daily banking convenience for easy account management

Using the Investec Credit Card's family account features can simplify your family's finances. It makes reaching your financial goals easier. Enjoy the ease of credit card family accounts and budgeting, along with daily banking convenience and a single monthly fee.

| Feature | Benefit |

|---|---|

| Credit Card Family Accounts | Easy management of family expenses |

| Family Budgeting | Simplified financial planning and management |

| Single Monthly Fee | Eliminates the need to worry about multiple fees |

Personal Banking Support and Services

If you have an Investec Credit Card, you're in good hands. The support team is ready to help 24/7. They're here for any questions or worries you might have.

Investec also offers personal banking services. You'll get advice from dedicated bankers. They help you manage your money in a way that fits you.

Here are some great benefits of Investec's personal banking support and services:

- 24/7 credit card customer support

- Dedicated bankers for personalized advice and recommendations

- Online banking services for convenient account management

With the Investec Credit Card, you can relax. Your banking needs are covered. This card offers both credit card support and personal banking services. It's a complete solution for managing your money.

| Service | Description |

|---|---|

| Credit Card Customer Support | 24/7 support for queries and concerns |

| Dedicated Bankers | Personalized advice and recommendations |

| Online Banking Services | Convenient account management |

By clicking the button you will remain on this website.

Conclusion: Is the Investec Credit Card Right for You?

The Investec Credit Card is a solid choice for those looking for a reliable credit card. It stands out in credit card reviews and credit card comparisons. It's perfect for people who want to manage their money well and enjoy convenience.

This card is great because it works well with digital wallets and has strong budget tools. It also offers top-notch travel benefits. It's perfect for anyone who wants to manage their money easily and travel well.

Choosing the Investec Credit Card depends on your financial needs and what you like. This review helps you see if it fits your goals and lifestyle. With its excellent customer service, it's definitely worth checking out in the credit card market.

FAQ

What is the Investec Credit Card?

The Investec Credit Card is a Visa Platinum card in South Africa. It has a credit facility priced at prime. Plus, it offers up to 45 days interest-free on all card purchases.

What are the key features of the Investec Credit Card?

The Investec Credit Card has a budget facility for up to 60 months for big expenses. It can also be loaded on digital wallets like Apple Pay and Google Pay.

What are the financial benefits and payment terms of the Investec Credit Card?

The Investec Credit Card has a single monthly fee. It also offers daily banking convenience. This makes it easy to manage your finances.

What are the budget management features of the Investec Credit Card?

The Investec Credit Card has family accounts and complimentary travel insurance. These features help users manage their budgets and expenses well.

What are the premium travel benefits and insurance coverage of the Investec Credit Card?

The Investec Credit Card offers dedicated bankers and premium travel benefits. These benefits provide peace of mind and convenience when traveling.

What are the family account options and management features of the Investec Credit Card?

The Investec Credit Card offers daily banking convenience and a single monthly fee. This makes it easy to manage your family's expenses and budgets.

What are the personal banking support and services offered with the Investec Credit Card?

The Investec Credit Card offers dedicated bankers and premium support services. This includes 24/7 customer support and online banking services.