Getting your Investec Credit Card online is easy and fast. The application process is simple. This way, you can save time and focus on other important things.

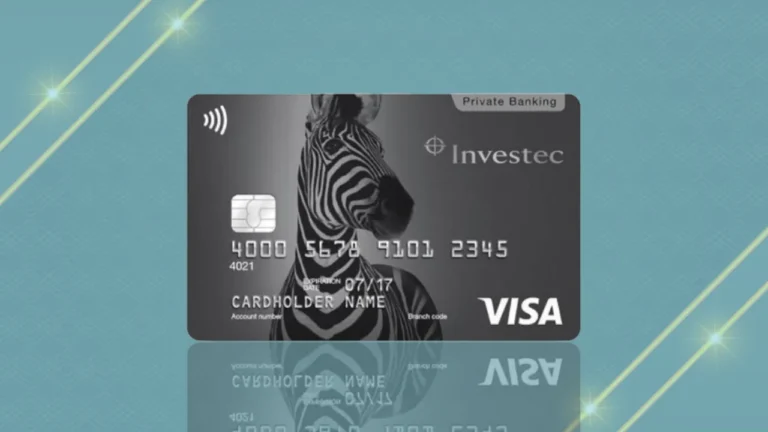

The Investec Credit Card offers great benefits.

It’s flexible and secure. The online application is easy to use, making it hassle-free.

You can get your card quickly and start using it right away.

Key Takeaways:

- You can request and obtain your Investec Credit Card online, making the process convenient and quick.

- The online credit card application process is designed to be user-friendly and hassle-free.

- Submitting your credit card application online saves time and effort.

- The Investec Credit Card offers numerous benefits and flexibility.

- The online application process is secure, ensuring your personal and financial information is protected.

- You can start using your new Investec Credit Card as soon as possible after approval.

- The Investec Credit Card provides a reliable and efficient way to manage your finances online.

Understanding the Investec Credit Card

When looking for a new credit card, it’s key to know what benefits and features it offers. The Investec Credit Card has many perks, like rewards programs, purchase protection, and travel insurance. These can give you peace of mind and rewards for your daily buys.

The Investec Credit Card makes life easier with contactless payment and online account management. You can keep track of your spending, make payments, and manage your account online or through the app. It’s designed to be easy to use, helping you manage your finances better.

Some of the main benefits and features of the Investec Credit Card include:

- Rewards programs that offer cashback or points for your purchases

- Purchase protection that covers you against loss, theft, or damage

- Travel insurance that provides you with medical and travel assistance

- Contactless payment for easy and convenient transactions

- Online account management to track your spending and make payments

Understanding the Investec Credit Card’s benefits and features helps you decide if it’s right for you. With its many benefits and easy-to-use features, it’s a top choice for those seeking a convenient and rewarding credit card experience.

Eligibility Requirements for Your Application

To find out if you’re eligible for a credit card, it’s key to know what Investec looks for. They check your age, income, credit score, and more. You need to be at least 18 and have a steady income to apply for the Investec Credit Card.

Investec also looks at your credit score when you apply. A high score can really help your chances. You can get your credit score for free from Equifax, Experian, and TransUnion.

- Age: You must be at least 18 years old to apply for the Investec Credit Card.

- Income: A stable income is required to demonstrate your ability to repay the credit card balance.

- Credit score: A good credit score can improve your credit card eligibility and help you qualify for better interest rates and terms.

Knowing what Investec looks for can help you decide if you’re a good fit for their credit card. Always read the terms and conditions before applying. This way, you’ll know you meet all the requirements.

How to Apply for Your Investec Credit Card Online

To start your online credit card application, visit the Investec website. Go to the credit card section. There, you can find the application form and start the process.

The online application is easy and secure. It lets you share your personal and financial details safely.

The application process asks for identification documents and income proof. You’ll get help every step of the way. After you apply, Investec will check your details and see if you qualify for the credit card.

Some key benefits of the online application process include:

- Convenience: Apply from anywhere with an internet connection

- Speed: Receive a response on your application in a timely manner

- Security: Investec’s online platform is designed to protect your sensitive information

By following these steps, you can make applying for your Investec Credit Card easier. The online application is a big part of Investec’s service. It helps you find a credit card that fits your needs.

The Application Review Process and Security Features

After you apply for an Investec Credit Card, your info is safe. The review checks if you’re eligible, including your identity and credit score. This makes sure your card goes to the right person, keeping you and the bank safe from fraud.

Investec uses top-notch encryption to protect your data. They also have two-factor authentication. This means you need a code sent to your phone to log in. These steps make sure your info is always secure, so you can enjoy your card without worry.

By clicking the button you will be redirected to another website.

FAQ

What is the Investec Credit Card?

The Investec Credit Card is a top-notch credit card. It comes with lots of benefits and features. This makes your financial life easier and more rewarding.

What are the key features and benefits of the Investec Credit Card?

This card has a rewards program and purchase protection. It also offers travel insurance and contactless payment. Plus, you can manage your account online and enjoy top-notch security.

Who is eligible to apply for the Investec Credit Card?

To get the Investec Credit Card, you need to be of legal age. You also need a steady income and meet the bank’s credit score. Check the Investec website for more details.

How can I apply for the Investec Credit Card online?

Applying online is easy. Just go to the Investec website, fill out the form, and upload your documents. The bank will then review your application and let you know their decision.

What security measures are in place for the Investec Credit Card application process?

Investec uses strong security to keep your info safe. This includes encryption, two-factor authentication, and fraud monitoring. Your data is always protected.

How long does the Investec Credit Card application review process take?

The review process usually takes a few business days. Investec’s team checks your info and decides on your eligibility quickly.

Can I manage my Investec Credit Card account online?

Yes, you can manage your account online. You can see your account details, transactions, and make payments. It’s all secure through the Investec online portal.

What happens after my Investec Credit Card application is approved?

After approval, Investec sends your card to you. Once you activate it, you can enjoy the benefits. This includes the rewards program, purchase protection, and travel insurance.